Things they don’t teach you in school –

Part 1: Taxes

So you’re a happy little artist, painting, posting and even selling your lovely art, hurray! And then it hits you like a dozen cats catapulted straight into your face… TAX TIME!!!

It’s terrifying, it’s confusing and it happens to everyone, yet no one seems to talk about it!!! It’s as common, mysterious and complex as mononucleosis (which I will also comment on later).

In this post I’ll share what I learnt during my first head-on collision with the tax form and some super useful resources, that helped explain the crazy jargon when it came to doing taxes as an artist.

DISCLAIMER: Please do not take this as official tax or finance advise!!! I AM NOT A TAX EXPERT by any means!

The Naive Beginnings

So picture this: A happy, little naive artist, who’s actually excited to do her taxes. She did all her homework at the start of her entrepreneurial adventure and feels prepared. She followed the guidelines:

Guidelines for starting a business:

- set up a separate bank account for your business

- set up another account for taxes (can be a savings account)

- transfer 20% of your earnings into your tax account every time you sell something

- keep track of your finances and expenses through a cashbook and Loss & Profit sheet

- put all your business receipts for the financial year into an A4 envelope marked the year for safe-keeping

As you can see, she has every reason to feel as confident as a student who’s been studying endlessly for the final exam. And not only does she feel she’s going to ace this exam, this artist also believes that this will make her venture official, like the initiation into being a proper business owner, a recognised Entreprenuer! Anxious to get it done she logs onto the MyIR site (New Zealand’s online tax site) only to find… nothing!

There’s no option to file a tax return! She clicks on every possible link and finds nothing. Then she thinks, “oh well, maybe it’s too early, it’s not the official end of the tax year, yet. I’ll try again later”

Later arrives and there’s still no option, she investigates and finds the problem: She did not declare to IRD that she was self-employed. No one had mentioned that in her research, it simply said “at the end of the year file a tax return.” She decides to simply write them a message through the system, telling them that she started a freelance business and would like to file a tax return. After quite a few weeks she receives a confirmation from IRD and a prompt to please file her tax return. Due to the delay she’s now late in doing so! Argh already the panic starts, okay here we go…

The Confusion is Real

If you’re a newbie like me, you might actually feel confident before filing your tax return, most likely not though! Most likely you’re like every other person I’ve ever heard of and absolutely dreads tax time. That’s because they know! They know what it actually means. I didn’t, I was innocent, I thought I’ll know the lingo because I managed to create a Loss & Profit Sheet.

How wrong I was.

The problem lies within the language.

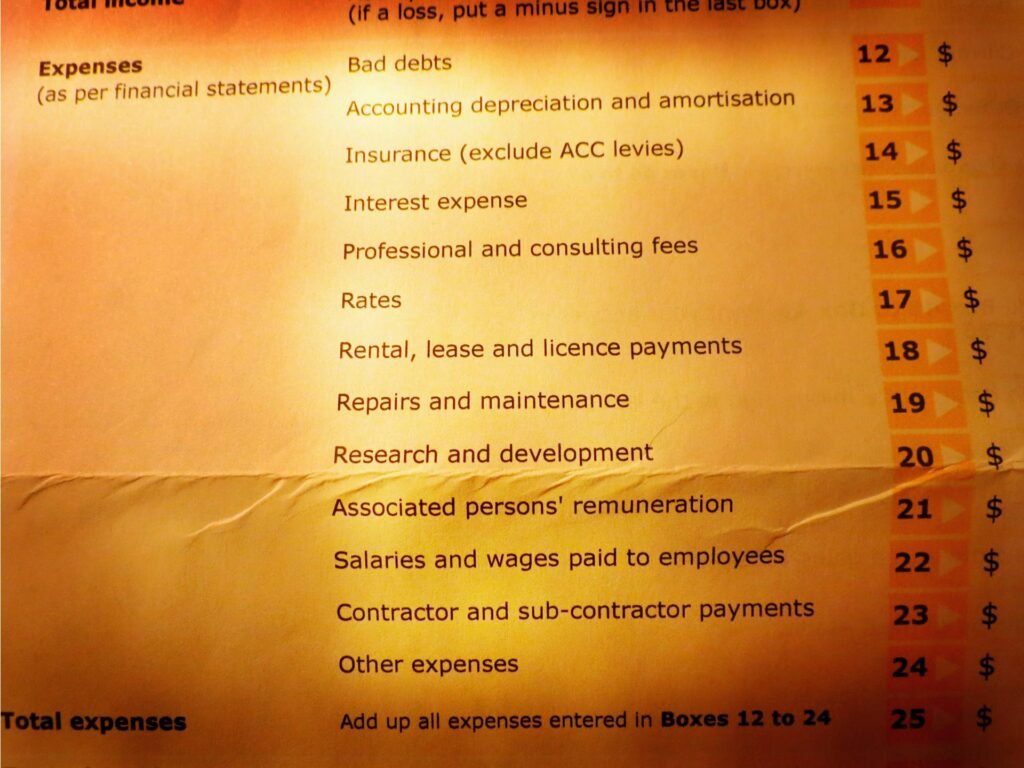

If you’ve ever laid eyes on a tax form, you’ll know what I mean. The accounting language is a strange and foreign one. The words seem oddly familiar, like you should know what they mean! But you don’t! There are words like ‘Opening Stock’ and ‘Closing Stock’. Simple words really, but what do they mean??? How do they relate to me as an artist. Why can I not make sense of them? Then you notice they’re in the section ‘Cost of Goods Sold’, maybe this helps… maybe it’s a clue. Depicting the words like a child pulling apart sticky noodles. Only ending up in a sticky noodley, wordy mess!

So how to make sense of it all?

Making Sense of the Jargon

To be able to do this I realised that I needed to really understand the words, I needed to learn the vocabulary of accounting!

And so the search began! It was a long and frustrating path, and to top it off I was suffering from Glandular Fever or as mentioned above Mononucleosis. What a giant pain in the behind. With my body feeling as heavy as a tug boat I crawled through the internet and here is what I found, so you don’t have to:

Nat’s (very unofficial) Tax Dictionary:

- Gross Profit = Total Income after your production costs. So basically the amount you have left after subtracting the rough cost of making the items you sold (COGS)

- Net Profit = Income after ALL of your expenses, including how much it costs to run it all, webpage fees, monthly subscriptions and all!

- Cost of Goods Sold (COGS) = Raw Materials + Direct Expenses + External Labour (I don’t think this includes your labour as a self employed or staff wages)

- Cost of Goods Sold (on tax form) = Opening Stock + Purchases – Closing Stock

- Opening Stock = This is an estimated guess of the cost of everything your business has at the start of the financial year. Raw materials, production cost of work-in-progress and production cost of your finished goods (not how much you’d sell it for, but how much it cost you to make.)

- Purchases = All of the direct expenses for your business over the year. The cost of raw materials, like paints, pens, paper. All of your manufacturing overheads, like monthly subscriptions for software, webpage and hosting expenses, cost of advertising (basically the expense of everything to run your business that isn’t shown in Fig. 4)

- Closing Stock = This is the estimated value (not retail price, but raw cost.) of everything you have left from your opening stock at the end of the year, including raw materials, productions cost of work-in-progress and production cost of your finished goods.

HOT TIPS:

– You only have to figure out your opening stock once, as the closing stock of your first year becomes the opening stock for your next year! Hurray!! I guess in theory your opening stock could be zero if you’re starting from scratch, but as an artist you are more likely to already have materials and paintings.

– When figuring out the production costs of my paintings, both the works-in-progress and the finished works estimations were quite loose. You either want to add the cost of paint you used with each painting in the production cost or subtract it from the value of paint left in your inventory in the closing stock. I hope that makes any sense.

Juicy Resources

Ok, I think those are the main words to understand to get the ball rolling. I could go on explaining a hell of a lot more on the topic, but instead I’m going to share some juicy and useful resources, which really helped me in my time of need…

This guy’s youtube channel @Accounting Stuff saved my brain from exploding! He is incredible, he takes a super complex and boring subject and explains it in an easy and entertaining way. He makes accounting actually make sense (mostly). I highly recommend watching some of his videos, if you want to grasp accounting as a small business owner.

So as you can see, it’s all a bit of a puzzle. Especially trying to relate the terms and concepts to the business model as an artist. It’s good to keep records of all of your expenses somewhere as you go. I found this lovely and generous lady called Sarah Booysen, who offers these excellent free excel templates, which you can use in google sheets, aswell. She also has a ton of useful information and unlike me actually knows her book-keeping! LOL

https://www.beginner-bookkeeping.com/excel-bookkeeping-templates.html

There’s a great book that fell into my lap at the perfect time as well, which tells you the type of documents you need to have, as a small business called ‘Where’s the Money?’ by Craig Rust. It may have been discontinued from print, but if you find a copy in a library or second hand shop grab it.

Alright, I’m going to wrap this up now, I really hope this little article was helpful. I’m also hoping it will help future me next year when the tax man comes knocking again, lol. As I said before: I am not an expert, so please do your own research, particularly because every country is different. Most countries have a great thing called a Tax Free Threshold, where you don’t have to worry about taxes until you’ve earned a certain amount… unfortunately New Zealand does not have that!

I also recommend seeking advice from a professional tax advisor or accountant. Funnily enough I tried this and he sent me away saying I shouldn’t bother declaring anything, as it’s just a hobby… Ouch. He obviously hasn’t seen my web page!

If you have any questions or comments on the topic, please leave them below, I’d love to read them and try to help if I can.

Much Love & Joy

Natalie xxx

Share it with your friends:

After a Funky notepad for keeping track of your cashflow? Try this one…